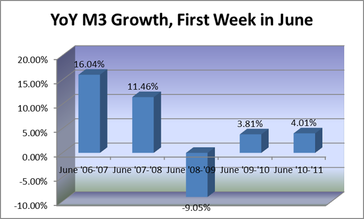

Two entries ago I talked about money supply and the election cycle, last entry I showed money supply (M3) growth over a June-June period. How are the two related? Changes in money supply affect the economy with a lag, usually 6-18 months. So the money supply growth--or contraction--6 to 12 months before the election will affect the state of the economy during voting time.

How did M3 change prior to the election under Bernanke? Prior to the 2008 election, it grew rapidly. Prior to the 2010 election it shrank at the fastest rate since the great depression. And prior to the 2012 electioin it grew at a very slow rate. Hmmm.

How did M3 change prior to the election under Bernanke? Prior to the 2008 election, it grew rapidly. Prior to the 2010 election it shrank at the fastest rate since the great depression. And prior to the 2012 electioin it grew at a very slow rate. Hmmm.

RSS Feed

RSS Feed