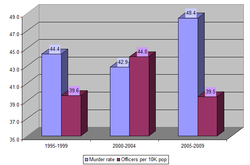

City of Detroit murder rates and number of police officers

A quick analysis of City of Detroit murder rates and the number of police officers shows exactly what is expected—that murder rates go down when more police are on the streets, and that fewer police on the streets means more murders. Data were from the Uniform Crime Reports (UCR), with a linear correction for inaccurate population data (UCR reported a 2010 Detroit population of over 900,000; the 2010 Census estimate is 713,777). Removal of police officers to balance the budget will most likely lead to further increases in the Detroit murder rate.

RSS Feed

RSS Feed