|

Last blog I talked about the 'coincidence' that the Fed has slowed M3 growth or even contracted M3 prior to the 2010 and now 2012 elections. If the hypothesis is right, and it is not past the window of opportunity to affect the 2012 election (for better or worse), then the Fed should be focussing on healing the economy and for the next 6-12 months we will see M3 expanding. A real-life test, where we don't know the outcome in advance!! But let's hope we are right, and that it is not something disfuncti

1 Comment

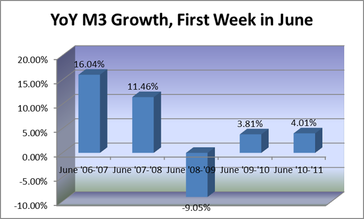

Remember the conspiracy theory of Fed manipulation of the money supply to weaken the economy prior to elections? To examine if this had any validity I created a weekly index of when the conspirator would want to have the greatest positive or negative effect on the money supply. A Republican conspirator wanting a favorable economy for the 2008 economy (Republican administration) might ramp up monetary expansion from about 18 months prior to the election (i.e. the first week in June 2007) to a peak at 6 months before the election (i.e. the first week in June 2008) and then retracing back to a normal growth pattern by June 2009. To generate an unfavorable economy for the 2008 mid-term election (Democrat administration) a conspirator might start to slow or contract monetary growth 18 months before the election (i.e. first week in June 2009) to a bottom about 6 months before the election (i.e. June 2010) before slowly returning to a more normal growth pattern by June 2011, before repeating the slow-growth exercise for the 2012 presidential election. I didn’t want to believe that the Fed would actually do this but guess what? This is exactly what happened. I ran a correlation between my index representing hypothetical conspirator behavior and actual M3 growth—and found a correlation of .88, or 88%. This is extremely high for economic data.

Does this mean that the conspiracy theory is right? Not at all, there are some statistical issues with using simple correlation and M3 growth rates (as opposed to acceleration) for analysis of what is a failry complicated economic phenomenon, and correlation is not causality. A little bit depends on how much you believe in coincidence. But M3 growth has an unsavory appearance, and for an institution as concerned with appearance as the Fed is, this is a worrisome sign. The Fed has some explaining to do! So we have seen the changes in the money supply related to the past three elections--those under Bernanke's Fed presidency. Why would there be a relationship between money supply and elections? Here are some possible reasons

1. There really isn't a relationship--it is just random coincidence. This explanation is easily debunked by statistical analysis--but more on that in later blogs. Also, do we really believe that everything the Fed does has no consequence and money supply is just random? 2. Bernanke thinks the economy is fine and doesn't need any help. Really? 3. Bernanke cares about the banking industry but not the economy. There has been a lot written on this in the financial pages and on the websites in the past few years, and to some extent it may well be true. But it doesn't explain election cycles. 4. The Fed has run out of ammunition to increase the supply of money. This is consistent with slowing year-over-year increases in money supply, but not with acceleration in money supply. Money supply growth decelerated prior to the 2010 election, accelerated dramatically in the interim between the 2010 and 2012 elections, due in part to quantitative easing, and has decelerated prior to the 2012 elections. Yet Bernanke says that another round of quantitative easing is available if necessary. So it must be that Bernanke thinks it is best not to have quantitative easing? 5. Fed decisions on the money supply are directly related to influencing elections. Oooh--isn't this a bit of a weird conspiracy theory? Is there really any evidence at all to support this? Which is your favorite explanation? More data and analysis to come on Two entries ago I talked about money supply and the election cycle, last entry I showed money supply (M3) growth over a June-June period. How are the two related? Changes in money supply affect the economy with a lag, usually 6-18 months. So the money supply growth--or contraction--6 to 12 months before the election will affect the state of the economy during voting time.

How did M3 change prior to the election under Bernanke? Prior to the 2008 election, it grew rapidly. Prior to the 2010 election it shrank at the fastest rate since the great depression. And prior to the 2012 electioin it grew at a very slow rate. Hmmm.  Slow growth in money supply (M3) has been a problem in this slow-paced recovery, and likely a significant cause of the slow

pace of the recovery. For the first year +/- of the recession M3 grew robustly year-over-year (YoY), continuing this growth through June 2009. For the twelve months ending in June 2010 M3 contracted by nearly 10%, a contraction unheard of since the depths of the Great Depression. Since the Great Depression YoY money supply growth has turned negative only for a few weeks, and even then in the magnitude of a percentage point or smaller contraction. In the past two years M3 growth has returned to positive numbers, but only about 4%, which is too slow to support a robust recovery. But we finally have good news. For the past two weeks, M3 has exceeded $15 trillion, for the first time in years. We are still below the peak levels, but there is hope for continued M3 growth that would help economic growth hopefully by the first quarter of 2013. Today's financial headlines include speculation that the Fed will loosen monetary policy--because of the situation in Europe and the economic doldrums in the US. I also believe that the Fed will begin to loosen monetary policy. Not because of the situation in Europe, that has been openly precarious for at least the past year. Not because of the US economic doldrums, we have been living with a best-case scenario of bumpy growth since 2009. But because of the election cycle. With less than six months before the 2012 election, it is time to pump up the money supply. Stay tune for the actual data on elections and short-term monetary cycles in Bernanke's Fed.

M1 and M2 are decelrating, rising 4.0 and 4.5% at seasonally adjusted annual rates, down from 18.1% and 9.8% over the past twelve months. But they are still rising, and at a reasonable pace. The other part of the puzzle is that velocity, the speed at which money circulates through the economy, seems to have stabilized. This sets the stage for M3 to rise--the key indicator that monetary policy will at long last help the economy to grow!!

Are there other reasons to believe that the Fed will finally encourage economic growth? Stay tuned for more! The G8 announced support for African leadership of poverty reduction in Africa. While this seems to be only common sense, it is unique in post-WWI history and culminates a monumental turnaround in developed country thought about development.

After WWI development/reconstruction was dominated by the Marshall Plan, which pretty much was a vehicle for the US to invest funds where the US thought best. My first trip to Africa was a visit to Senegal in the mid-1980s. The farmers I was working with were peanut farmers, but no one was helping them with peanuts because the US peanut lobby didn’t want competition. I asked why couldn’t we help with wheat, but the Canadians had claimed that commodity. What was the US working on? Corn. In the mid-1990s USAID went to Uganda and made an offer to help create a regional research organization that would assist countries in achieving their national agricultural research goals, be eligible to receive donor funding, spend funds on African priorities including a small grants activity that would support proposals for collaborative work among African scientists in the region and with proposals being reviewed and funded in a transparent process based on the quality of proposal. I was privileged to be at the meeting where this offer was tendered by USAID (with a previously brokered agreement) and accepted by Dr. Joseph Mukiibi, then Director of the Uganda National Agricultural Research Organization. In his acceptance speech Dr. Mukiibi likened African pursuit of donor funds for expenditure on African priorities to his courtship of his wife. “One day”, Dr. Mukiibi said, “walking to work I saw at the bus stop the most beautiful woman in the world. So I stopped and introduced myself and asked her to marry me. She laughed and said no. But every day I made a practice of talking to her at the bus stop, and as she was getting on the bus, I always asked her to marry me. And she always laughed and said no. Then one day, as she was getting on the bus, she turned to me and said ‘Yes!’ . As I watched the bus pull away I thought, Oh s**t, what do I do now?” The Association for Strengthening Agricultural Research in Eastern and Central Africa was created out of that process and remains a successful, African-owned research organization today. The New Partnership for Africa's Development was adopted by the African Heads of State of the OAU in 2001 and ratified by the African Union in 2002 as the primary regional development body. The Comprehensive Africa Agriculture Development Programme (CAADP) is NEPAD’s flagship program for promoting agricultural development to enhance growth and reduce poverty and hunger. The success of ASARECA as an African owned organization successfully investing in agricultural growth was a significant contributory factor that helped enable the emergence of CAADP. The success of CAADP was a significant contributory factor that helped enable the emergence of this week’s G8 agreement to support the African-owned New Alliance for nutrition and food security. President Obama yesterday recommited to the pledges made in his July 2009 speech in Ghana and stated that the G8 was announcing a New Alliance for nutrition and food security that would accelerate the progress made to date. There are several key components of the New Alliance: an historical acknowledgement of African leaders as leaders of African efforts to end poverty and undernutrition, an emphasis on improved policies, donor concordance with African policy priorities, and accountability for progress against poverty. President Obama also emphasized positive relationships with the private sector, although I think the emphasis on African leadership, donor concordance, and accountability are the key underpinning concepts that enable any meaningful relationship with the private sector.

The Guardian is reporting that the upcoming G8 summit will announce a New Alliance to increase food security and nutrition, apparently with a focus on Africa. This will be a useful offset to US biofuels policy--the Washington Post this morning reported that 39% of the US corn crop is headed for ethanol--which tends to increase food price levels and volatility by linking food crops to energy prices and volatility. Details are forthcoming, hopefully this weekend.

|

James F OehmkeMy biases are socially liberal and fiscally conservative, but I try to present objective economic analysis and interpretation in my blog. Archives

July 2012

Categories |

RSS Feed

RSS Feed