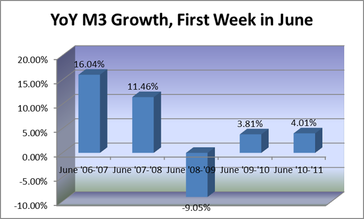

Slow growth in money supply (M3) has been a problem in this slow-paced recovery, and likely a significant cause of the slow

pace of the recovery. For the first year +/- of the recession M3 grew robustly year-over-year (YoY), continuing this growth through June 2009. For the twelve months ending in June 2010 M3 contracted by nearly 10%, a contraction unheard of since the depths of the Great Depression. Since the Great Depression YoY money supply growth has turned negative only for a few weeks, and even then in the magnitude of a percentage point or smaller contraction. In the past two years M3 growth has

returned to positive numbers, but only about 4%, which is too slow to support a robust recovery.

But we finally have good news. For the past two weeks, M3 has exceeded $15 trillion, for the first time in years. We are still below the peak levels, but there is hope for continued M3 growth that would help economic growth hopefully by the first quarter of 2013.

pace of the recovery. For the first year +/- of the recession M3 grew robustly year-over-year (YoY), continuing this growth through June 2009. For the twelve months ending in June 2010 M3 contracted by nearly 10%, a contraction unheard of since the depths of the Great Depression. Since the Great Depression YoY money supply growth has turned negative only for a few weeks, and even then in the magnitude of a percentage point or smaller contraction. In the past two years M3 growth has

returned to positive numbers, but only about 4%, which is too slow to support a robust recovery.

But we finally have good news. For the past two weeks, M3 has exceeded $15 trillion, for the first time in years. We are still below the peak levels, but there is hope for continued M3 growth that would help economic growth hopefully by the first quarter of 2013.

RSS Feed

RSS Feed