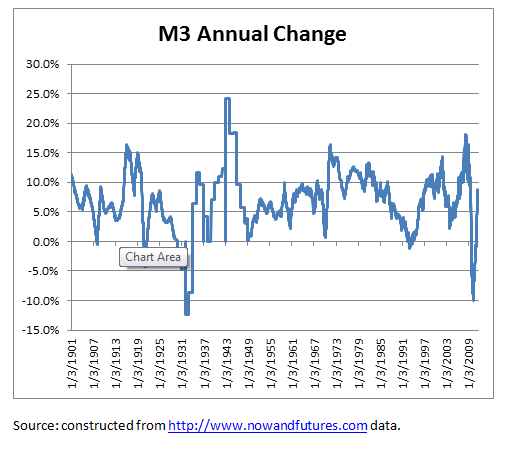

Money supply is not only one of the best indicators of economic health, it is also predictive and new figures are published weekly. I prefer the M3 measure of money as it incorporates some forms of credit in addition to cash, CDs, and other monetary constructs. The Fed no longer publishes M3 statistics; I use the data published at http://www.nowandfutures.com .

The most distinctive characteristic of recent M3 history is the 10% annual decrease in M3 from 2008 to 2009. This decrease is bigger than any other recorded decrease outside of the Great Depression. It shows not only the severity of the recession, but also the Fed’s de-emphasis of expansionary monetary policy during the depths of the Great Recession. That’s right, once the Fed lowered interest rates it turned attention away from money and allowed the second largest monetary contraction in the monetary history of the United States.

The most distinctive characteristic of recent M3 history is the 10% annual decrease in M3 from 2008 to 2009. This decrease is bigger than any other recorded decrease outside of the Great Depression. It shows not only the severity of the recession, but also the Fed’s de-emphasis of expansionary monetary policy during the depths of the Great Recession. That’s right, once the Fed lowered interest rates it turned attention away from money and allowed the second largest monetary contraction in the monetary history of the United States.

RSS Feed

RSS Feed